Simulation tool and pilot projects simulations reports

Citizen Financing EFSI Financing Investment Platforms - 09 March 2021

The main aim of this document is to assess and evaluate the investment programs for energy efficiency in the four pilot countries/regions for being processed under the CFs4EE Financing Schemes to be built and operated at a later stage of the CitizEE project.

The tool has been developed by Energinvest taking into account the scope of the CFs4EE Financing Scheme of each Pilot Region (please find further information in the Evaluation-and-Action-Plan-for-Citizen-Financing-Schemes-for-Energy-Efficiency-CitizEE). In particular, all the Pilot Regions were to use loans and potentially equity as financing products to the final recipients while none of them addressed a guarantee mechanism under their CFs4EE. As a consequence, the simulation tool has been developed to evaluate the financial feasibility of the setting-up of an Investment Platform combining debt and equity as funding components and debt and equity as portfolio of investments. Pilot Regions have structured their investment program data in order to feed the simulation tool. They were able to use the outputs of the given data template, their own sources of data or estimates when the pipeline of investment projects was not yet fully quantified.

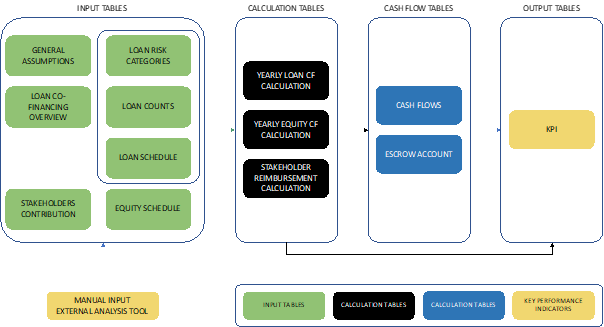

As illustrated in the Fig. 1 the tool has been structured with input tables allowing the pilot regions to define the characteristics of:

- the Investment platform (fund) such as investment period, maturity, and management fees structure, based on standard data or on pilot regions assessment;

- the loan and equity contributions from co-investors (stakeholders) based on standard data or on pilot regions assessment;

- the loan and equity portfolio of investments based on the investment program assessed by the pilot regions.

Calculation tables and cash flow tables deliver the outputs of the simulation. The final result is a Key Performance Indicators (KPI) table indicating the total volume of funds under management, the total volume of funds disbursed by the Investment Platform, the total management fees supported by the investment Platform and the internal rate of return (IRR) of the funds.

The main aspects of the input tables are described in detail below.

Fig. 1 High Level architecture of the simulation tool

The report is available for free download here.